Inflation has dominated news channels and headlines this year, and it’s spooked both consumers and investors alike. What exactly IS inflation? How does it work?

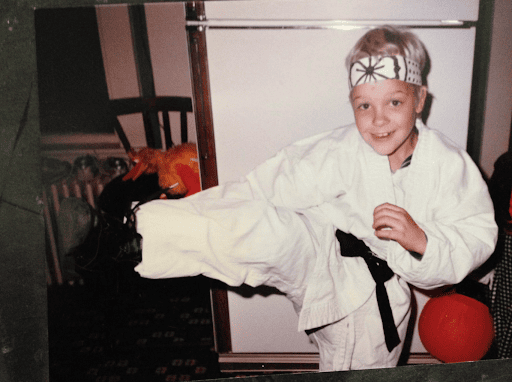

In the 1980s, we used to dress up in the classic costumes: Paperama Smurfs, Transformers, or Storm Troopers. Or maybe our parents would sit down to make our costumes from different items around the house.

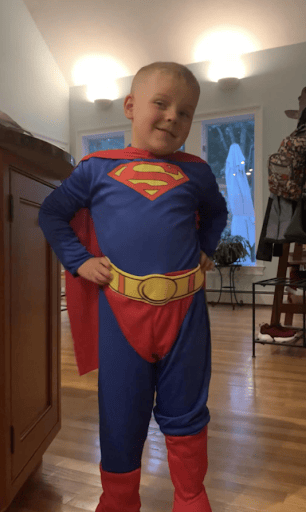

Things are a little different today. We buy our designer costumes at big Halloween-themed stores, picking from mass-produced Marvel costumes or the latest in dozens of streaming-service-derived characters.

Decades have passed, of course, and times have changed. The same applies to the economy, and more specifically, our national flow of money. Think about those costumes and how much they might cost: the price has certainly gone up since the 1980s — the result of inflation!

Inflation has dominated news channels and headlines this year, and it’s spooked both consumers and investors alike. What exactly IS inflation? How does it work? And should you be worried about it?

It’s a tricky concept to understand, but let’s break it down – and how it relates to your own financial situation.

Understanding Inflation: A Quick Primer

Inflation is a word often spoken about in the news and in passing conversation — and for those who don’t understand it, it can be intimidating and fear-inducing. Let’s deconstruct it!

In 1966, an average candy bar cost $0.05.

In 1986, it cost around $0.40.

In 1996, 2006, and 2016, that same candy bar cost $0.70, $1,10, and $1.30 respectively. That’s 26 times the original cost over 50 years.

It’s not just the cost of candy bars, either. Many items have jumped up in price: everything from chicken wings and toilet paper, to building materials and cars. Why is that? Inflation! Inflation is the rising costs of goods and services of all kinds in an economy.

- Demand. When the demand exceeds the supply, prices will rise in “competition” for fewer goods. People have more money to buy products now because of stimulus payments, ultra-low interest rates, financial market peaks, and housing market booms.

- Increase in production costs. Due to a labor shortage, the actual cost of labor for production has gone up significantly.

- Supply-chain disruption. Covid-19 has caused significant global shutdowns in manufacturing, creating a shortage of many goods.

40-year lows in debt service and highs in household networth have U.S. consumers looking to buy more candy bars, more pumpkins, most costumes, more yard decorations… you name it. But what’s the rub? It costs more today.

In Q2 2021, we saw a 5.3% inflation rate on the Consumer Price Index (CPI).

So…How Can We Defend Against Inflation?

Inflation will, without a doubt, affect your personal finances. The best defense against inflation is an offensive strategy. You can’t necessarily keep up with inflation in a long term fixed income portfolio.

Not only are prices rising, but so is the length of time that your nest egg will need to provide income for you. That’s what we call “purchasing power” and “longevity” risks.

Let’s examine this case study: a 65-year-old couple has a 50% chance that at least one of them will live until 93. That means planning for a 30-year retirement phase. As a side note, believe it or not, if you’re born today there’s a 50% chance of living until you’re 100 years old (Source: USA Today)!

A longer lifespan requires more money to last for longer. When you factor in inflation, you can expect life to cost you 40x more. With interest rates on a 30+ year skid having peaked in the early 80s, your bank account and your fixed income portfolio might not necessarily be able to keep up with your cost of living. Over the last 30 years, the S&P 500 has gone up 11 times. The companies that make up the S&P drive earnings and price appreciation through the rise in prices of the everyday goods and services we’re paying more for.

Market decline is inevitable, of course. A healthy market has periodic corrections, meaning we can benefit from risk and reward factors. The key to the financial market? Patience! Over the last 60 years, the market has been up over 77 times due to advancements in technology, innovation, and more.

When you’re looking for specific, tailored strategies to battle inflation in the long term, don’t hesitate to get in touch with our experts.

In the long term, there’s no way we can’t be invested in equities for a 30-, 50-, and 75-year horizon. If you’re young, or even middle-aged, you still have decades to plan for your financial future and any rising costs associated with that future. This doesn’t mean we shouldn’t have an allocation to fixed income – because that’s where we look for safety and less volatility along the way.

The Bottom Line

The OECD has warned that high inflation is projected to continue over the next two years, meaning the cost of candy bars and Halloween costumes is only going up from here! This makes it important now more than ever to understand how inflation will affect your finances. If you’re feeling confused, overwhelmed or uncertain about how to navigate inflation and allocate your assets, it can be highly beneficial to work with specialists who can plan for your specific situation. Reach out to us at Arsenal Financial and let’s have a conversation!