The level of volatility in 2022 has been a wake-up call for many investors, and a stark reminder that investing isn’t a risk-free endeavor. The conversations we’ve had with our clients indicate the need for a change in expectations after a mostly upward trending ride since April 2020 for stock indexes and low interest rates helping bond values through late 2021.

As we prepare for this next chapter for savers and investors, it is important to go back to the original drawing board full of those life goals (“Retire at 62”, “Pay for half my childrens’ college” or “Buy a second home in 10 Years” for example) and remember why investing plays a role in the first place.

Investors, especially those over 50, should revisit their savings plans, career paths, and family needs as they evaluate how their investments serve their future. Let us break it down for you.

What is market volatility?

Market volatility is a term that refers to the frequent, significant price movements of the stock market, both up and down. The bigger the swings, and the more frequent the swings, the more volatile the market.

An analogy we like to use when explaining the stock market and its volatility: the stock market is like riding an escalator while playing with a yo-yo. Think of the stock market itself as the “escalator” – which has gradually moved upwards over time. The natural upwards movement of the “escalator” can be attributed to a variety of factors, including increases in global population, innovation and efficiency, and revenue and profit growth for companies.

In times of market volatility, or the “yo-yo” – the focus can easily shift away from a 20 year investing timeframe to what has gone on this week. Completely understandable. It is important to remember that there will always be ups and downs in the stock market – every single day.

Having the foundation of a Financial Plan can help to focus on the escalator and NOT the yo-yo. If you place too much emphasis on the yo-yo, you may be swayed by emotion, and make knee-jerk reactions in response to a shorter-term move in the financial markets.

Though market volatility may seem jarring and unexpected at the time, the reality is that it’s a normal part of investing and nearly every portfolio will encounter some type of volatility over its lifetime.

The history of the stock market (the escalator goes up)

Since the New York Stock Exchange opened in 1903, the market has seen many episodes of market volatility. In over 23 years of working with clients, we’ve built a few scars together. We’ve lived through the dot-com bubble & 9/11, the Great Financial Crisis of 2008 and the market decline in the early weeks of the spread of COVID-19 in the U.S. There are other chapters that many investors have long forgotten about such as the market correction following the US Treasury Debt downgrade, three separate 10% dips from 2015-2016 due to global economic concerns, and the Christmas Correction of 2018 following rising rates.

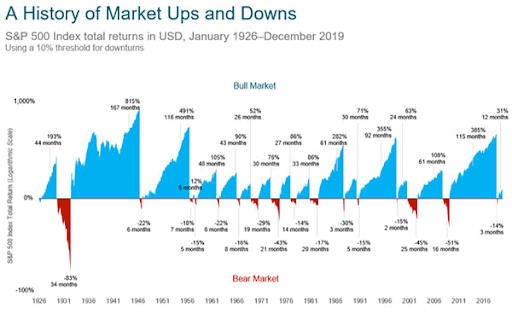

In fact, there have been sixteen major market declines since 1926 that lasted, on average, twelve months. Each decline, however, was followed with a bull market that lasted for nearly 60 months, on average.

Investors will watch their portfolios drop and feel like it may take years and years for them to return to their pre-drop levels. However, historically speaking, even as the yo-yo goes up and down, the stock market “escalator” as a whole will continue to go upwards. You just need to be patient. That’s why it’s so important to have perspective when thinking about a volatile market: the gains have oftentimes been followed by much longer, more sustained periods of growth.

Photo: Courtesy of Todd Pisarczyk

What causes market volatility?

Many different factors can cause market volatility. Here are some of the most common factors:

1. Political Factors

The stock market and the government are interdependent, and the government plays a major role in the regulation of industries and in this way the government indirectly impacts the market. Trade agreements, tax legislation, geopolitical instability, elections and policy can all have an impact on the market, especially when investors react. This, in turn, can influence share prices.

This time around we are seeing the impact of geopolitical issues impacting the stock market more than political issues at home. In addition to the horrible humanitarian crisis in Ukraine and Russia, the conflict has far-reaching impacts on supply, demand and spending habits, which changes the outcomes for global companies.

2. Industry factors

Events can cause volatility within an industry or sector and hence influence the market. We are seeing this right before our eyes with the impact on global oil and gas supplies. While there is no easy fix to the rising prices of energy, this chapter in the energy industry will eventually turn the page to a new chapter as it always does. Diversified investors over time will be exposed to part of the solution and innovation within the industry

3. Economic Factors

The economy may play the most important role of all. Monthly jobs reports, inflation data, consumer spending figures, and more, can all influence the market. When the economy is meeting and exceeding expectations, stock prices tend to react positively to strong earnings. Likewise, when the economy misses key marks, markets may become more volatile.

Today’s economy has a strong underpinning of low unemployment, high demand for jobs and projected all time highs for US companies. The major headwind is the two “I”s: inflation and interest rates. The new regime of higher inflation and rising rates changes the investor playbook.

Should you invest if the market is volatile?

So, should you invest when the market is volatile? It all depends on why you are investing, what you are saving for and when that event happens. As a Financial Planning practice that helps families and individuals planning for retirement – the what and why is often for a long-term goal or life change which allows for years (not days) of investing.

For those investing with a longer term time-horizon, volatility in the price of investments will be something to contend with for the duration of your savings plan. Without volatility, the “market” cannot determine the value of an investment. A company like Amazon has gone through its ups and downs in price in the last 25 years, but the growth in its services, footprint, revenue and profits has grown exponentially in that time frame.

Remember, focus on the elevator and not the yo-yo.

If you’re a young investor…

If you’re just getting on the investing “escalator”, it may be easier to stick it out and continue to contribute to investments like your workplace 401k Plan. A younger investor has many, many more years to ride the escalator until you withdraw your investments for income. During market corrections, 401k investors can continue to contribute to their plans – taking advantage of market dips and opportunities to “buy-low”.

If you are mid-career…

Most of our clients have more than half of their working careers behind them. This means there is more at stake and still a ways to go. Regardless of the condition of the stock market, our mid-career clients need to reassess their goals (what will I need money for in the short, intermediate and long term) and their tolerance for risk and need for growth in the “goal bucket”.

Are college bills less than a year away? Maybe that 529 shouldn’t be in stock anymore. Is there still 15 years until retirement with 20-30 years of withdrawals on that IRA money? Maybe accepting the risk of the stock market for more than half of your portfolio is acceptable?

Like going to the doctor or dentist, it’s essential to periodically take stock of your financial health!

If you’re close to retirement age…

It’s understandable to feel nervous about market volatility, especially if you find yourself close to retirement age – or are no longer working full-time. An investment portfolio for those close to retirement or those in their retirement years should NOT look like the 401k of a younger investor with decades to make it through market cycles. However, this demographic still needs growth of capital. In a day and age where banks yield you next to nothing and inflation is running at 40 year highs – this is not easy.

A strong portfolio for this group should split its focus on generating dividends (and with yields up – this is getting easier to do!), preserving capital and still seeking a degree of capital appreciation. There is no blanket solution and the proper solution very much depends on one’s retirement readiness, income sources in retirement and individual tolerance for risk.

Our Take on Investing in Volatile Markets

There are periods when being an investor can feel daunting, especially when the market continues to yo-yo. Much like camping, you’ll need a survival kit:

- An overall Financial Plan is recommended as a companion to an investment portfolio.

- When investing in stocks, bonds, mutual funds, ETF, real estate, businesses and other alternative investments, establish some risk thresholds before you invest.

- For existing investments (e.g. college savings, retirement funds, brokerage account, inheritance) revisit the use of the funds and risk thresholds on each “bucket.”

- Be realistic about what your investments can & can’t do. Keeping money only in cash or government bonds will not outpace inflation over the long-run… and stocks do not go “up” in a straight line.

- Consider a second set of eyes (spouse, friend, trusted advisor, colleague) if you are unsure about your investment plan or what to do (or NOT do) during moments of market turbulence.

- Be patient. Successful investing always includes one important ingredient: TIME.

As always, we encourage conversations with our clients and partners and welcome new conversations from our readers.

Disclosure: The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly.

The economic forecasts set forth in this material may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

All investing involves risk including the possible loss of principal. No strategy ensures success or protects against loss.

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities.

Any investment should be consistent with your objectives, time frame and risk tolerance.